Article

Insourcing vs. Outsourcing: 3 Questions to Ask

Ongoing changes in the regulatory, competitive, and economic landscape are driving many financial institutions to review their credit card program strategy and evaluate whether to invest in growing an internal program or explore an outsourced solution.

1. What is the true cost of a credit card program?

In addition to processing costs, rewards program management, and network dues — consider costs related to changes in regulations (CECL), variable interest rates, and capital reserves. Administrative costs necessary to support the program include managing risk, fraud, collections, disputes, third-party provider relationships, employee hours, and more. Don’t forget the cost of product and technology maintenance and upgrades.

2. What do my customers need?

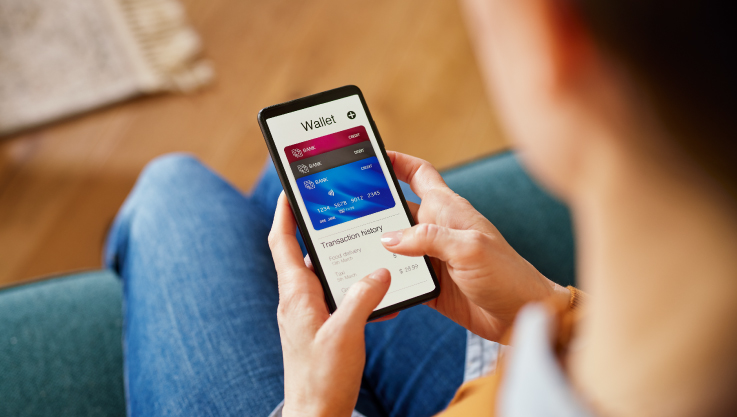

It shouldn’t be a surprise that a digital-forward experience is highly ranked, but strong products and reward programs, and fraud protection are closely ranked by cardholders. Many smaller financial institutions have more than doubled their investment in digital transformation in the last few years. Can your financial institution make that investment to meet customer needs?

3. When should I consider outsourcing?

Whether staffing, liquidity, or resources are prompting an evaluation, the time is now. As you consider your options, review the following questions:

- Can our financial institution maintain a competitive credit card program long term?

- Do we have the capital to invest in digital capabilities to meet customer expectations?

- Can we allocate the resources needed to manage the program’s profitability and risk in a changing economy?

Many financial institutions are hesitant to explore outsourcing because they fear losing control over the customer experience. The key to mitigating this concern is to choose the right partner. A quality partner should understand the financial institution’s culture and provide program visibility and ownership.

Learn more about these three considerations here.

Tags:

ARTICLE

Why Financial Institutions Should Act Now on Virtual Cards

Whether through integration with digital wallets, enhanced fraud protection, or real-time issuance, virtual cards offer a compelling value proposition across generations and tech segments.

ARTICLE

Driving Partner Growth with Technology

Elan partners benefit from the scale and ease-to-market ability of our ongoing investment in technology — at no cost. Here are a few of our recent enhancements.

Start a conversation

If you are interested in learning how Elan can help build your credit card program, we'd love to hear from you.